“Board Performance Reviews” => In | “Board Evaluations” => Out Understanding the new Direction.

Gavin Wehlburg, Managing Partner, GRC Consulting

We focus on solving complex problems for Boards and Executive Leadership

utilising our creative skills, methodologies and technologies.

Published, April 2022. The views expressed are personal and my interpretations.

Intending to be effective from January 2022 onwards, ICSA (“The Governance Institute” – The Institute of Chartered Secretaries and Administrators), as tasked by the Department of Business, Energy and Industrial Strategy (BEIS), UK – to assess the quality of independent board evaluations within the UK listed sector (FTSE 350) and identify ways in which it might be improved, issued their final report January 2021.

We set out in this article a simplified overview, key messages and takeaways for Boards, executives, company secretaries and other interested governance readers.

Simple to understand, Simple to implement and Simple to use. – #GRCConsulting

As the heading suggests, the reference to former “Board Evaluations” and similar should be replaced by “Board Performance Reviews” going forward, including flow through to related frameworks, such as the UK Corporate Governance Code on its next revision.

#BoardPerformanceReviews should therefore be referred to as the “de facto”, and we expect, given the sensible and beneficial practical advice provided, for this development to flow globally across leading corporate governance jurisdictions and their frameworks for all #Boards and their #Directors, and be adopted by all Boards who take their responsibilities for continuous improvement seriously.

Five Key Takeaways for the Busy Reader

- The prior use of “Board Evaluation” is to be replaced by “Board Performance Reviews”.

- From January 2022, Boards and Board Reviewers should adopt the new framework.

- The framework is voluntary, mutually reinforcing and without Regulatory oversight.

- BEIS in the UK will drive watchful progress reviews/FRC will review Corporate Reporting.

- The framework is excellent/focused on leveraging Board/organisational performance.

Why the BEIS Review?

Notwithstanding the obvious that robust and correctly utilised Board Performance Review processes provide beneficial performance improvements for both the Board and its wider organisation, some of the following justifications are driving the review:

- Ongoing drive to improve marketplace governance, transparency, and performance.

- The 2018 BEIS paper on “Insolvency and Corporate Governance” highlighted the need, through institutional investor engagement, that “the market for independent board performance reviews should be reviewed with a view to introducing minimum standards …”.

- 2018 also saw actions taken by the FRC (Financial Reporting Council) to strengthen the UK Corporate Governance Code – which had potential impacts.

- 2018 also saw Board Performance Reviews addressed under the FRC’s revised guidance on “Board Effectiveness”.

- It is a legitimate right for Stakeholders to seek greater accountability from both Boards and their companies and the Board Performance Reviewers as to the robustness and processes adopted, the evidence and outcomes, and hold the Board accountable for transparent, effective improvement actions.

The pressure was mounting, and the need was evident, as were the potential benefits for all concerned stakeholders.

What was the Primary Objective? – of “Board Performance Reviews”

The primary purpose of regular Board Performance Reviews is to:

A. Assist the Board in continuously improving its performance, and

B. Continually improve the performance of the Company.

Recognising that:

C. all Boards may require differing support.

D. Engaging an independent reviewer can bring greater objectivity and fresh insight, which in addition to annual Board processes, should be undertaken every three years.

E. Whilst the engagement of the independent Reviewer does not transfer responsibility to them, nor are they to provide “assurance” to any stakeholder as to the Board’s current or future effectiveness, their role is to identify issues that the Board should consider.

F. The Board’s role is to take appropriate action to address the identified issues.

G. The stakeholder’s role is to hold the Board to account for effective action/performance.

H. That the Board is entirely responsible and accountable to its stakeholders.

What was the Review Process and Timeline?

Steering Group

Public Consultations

May-July 2021

Workshops

October 2021

Final Report

January 2021

What did the Review Look at?

In addition to the feedback from involved parties, it considered:

What did the Review Find? – For “Independent Board Reviewers”

This is not a mature market or service. Early numbers appear to have been weeded out. Previously dominant market players are giving way wins to new market players. The market for services is becoming more competitive. However, the availability of quality comprehensive information is thin on the ground but a positive picture.

Encouraging to find a positive and improving Customer Satisfaction over the prior five-year period. The APPCGG in 2018 (the All Party Parliamentary Corporate Governance Group) reported an 85% satisfaction rate with surveyed listed companies conducting externally facilitated reviews which also noted that “it was felt that reviews had become more professional [in the previous five years]”.

The APPCGG also suggested that “word of mouth” is still the most common way companies identify potential reviewers. This is not conducive to nor compatible with formal and competitive selection processes.

So, summarising the context for Independent Board Reviewers:

What did the Review Find? – For “Listed FTSE 350 Companies”

Whilst there is compliance with certain aspects of the “Code”, concerns remain over:

- Thoroughness of some external Board Performance Reviews.

- Transparency over the Board Performance Review processes undertaken.

- Transparency over the outcomes of the Board Performance Reviews.

- Transparency in respect of the actions generated and undertaken based on the issues.

- Transparency of the Board Performance Review in its fuller context for Public Reporting.

Whilst the position and market are changing; nonetheless, there remains concern that there are too few Service Providers at the top. Additionally, there is a lack of data and or the relevant tracking over the number of times the same Reviewer has been engaged and then similarly over the relationship of the Reviewers Board Performance Review Fees relative to the Reviewer Other Fees from the same clients. There is still a preference recorded for Questionnaire-based Board Performance Reviews, which, whilst they can and do play a valued role, do not on their own support robust “full scope” Board Performance Reviews.

In moving forward, there needs to be an improvement to the Board’s processes, their transparency, outcomes, agreed-upon actions and the appropriate reporting in public disclosures for stakeholders, which of itself, in respect of outcomes and actions, has seen “no evidence of improvement in this area as a result of the updated “Code”; in fact, the figure has fallen slightly compared to 2018”.

So, summarising the context for Listed FTSE 350 Companies:

Some Review Conclusions and Implications

1. Positive Position

2. Balance of Emphasis

3. Varying Needs

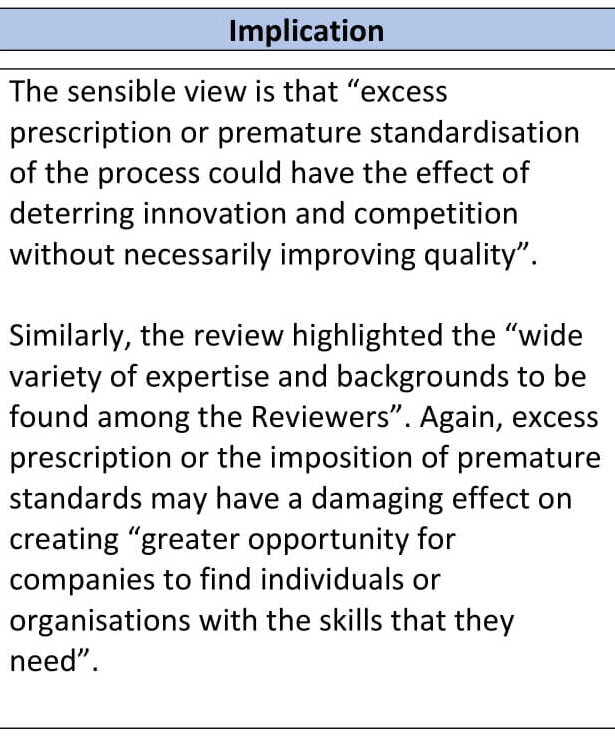

The Solution and How it Works

The over-arching principle to be borne in mind is that the Solution measures “are intended to be mutually reinforcing”.

“By asking companies to disclose to shareholders whether the board reviewer they use is a signatory to the Code of Practice, this will hopefully incentivise companies to appoint reviewers that have committed to the standards in the Code and, in turn, encourage reviewers to do so.”

“Similarly, shareholders would be able to challenge companies that chose not to adopt the voluntary principles.”

“The aim is that the package of proposed measures will develop into a market-based mechanism for raising standards and increasing accountability, without the need for regulatory intervention.”

|

With the intention to be effective from January 2022 onwards, to be “light touch” and “voluntary”, whilst seeking a framework that generates credibility in the market to be accorded appropriate recognition and that works within other existing frameworks and the Corporate Governance Code, that BEIS identify a suitable organisation to take ownership of the Code of Practice and Register, initially on a light-touch basis, that “over time, it might be appropriate for this organisation to take on more functions …. “. They would also initially agree on maintaining the public register of signatories (including the check processes to becoming a signatory, etc.). They would cover assessing whether the signatories have made all the disclosures required by the Code of Practice. The Code of Practice would be maintained and receive input from organisations such as the FRC, which may issue the guidance for listed companies. Whilst the FRC will, as part of their mandate, “be reviewing how companies are complying with the relevant provisions of the Corporate Governance Code”, .. “it would seem sensible for it to look at the use made of the Code of Practice and Principles at the same time. Additionally, as with this review, it would be “important for BEIS formally to conduct or commission reviews over the impacts of these arrangements to determine whether they are having the desired effect and if further action is required”, together with appropriate other interim assessments. |

The Public Register would reflect the names of those ratified Reviewers and serve as a reference source for those requiring Board Performance Review Services. Ratification processes would include applicant Reviewer compliance with those disclosures required by the Code of Practice, including their commitment to adhere to the Code of Practice, illustrating how they have done so.

In line with the principle of addressing both participants in the Board Performance Review process, the Code of Practice contains respective Best Practice Principles. Whilst the Corporate Governance Code and the “Guidance on Board Effectiveness”, among other sources, deal with the conduct of reviews, “value” was seen in extending the aforementioned “comply or explain” provisions to encompass additional “good practice principles that go further” to assist both parties and interested stakeholders on the process, disclosures and related matters and addresses both internal and external Board Performance Reviews.

Board Reviewers make the required application and demonstrations to gain ratification to become listed within the Register of Reviewers for Board Performance Reviews.

|

Boards and or their organisations have access to the Public Register to find, inquire, and engage Board Reviewers who meet their Board Performance Review requirements. |

Through ratification, Board Reviewers commit to and undertake Board Performance Reviews according to the Code of Practice.

|

Boards and or their organisations, through their voluntary commitment, “adopt the principles of good practice covering the selection of the Reviewer and how the review is conducted and reported on”, together with other required disclosures. |

Shareholders within the broader stakeholder community hold the Board and organisation to account for effectiveness and performance. The Code of Practice and the Public Register provide the incentive and signal to stakeholders on the seriousness of intention with respect to these Code of Practice obligations and which measures the Board and or their organisations may be held to account.

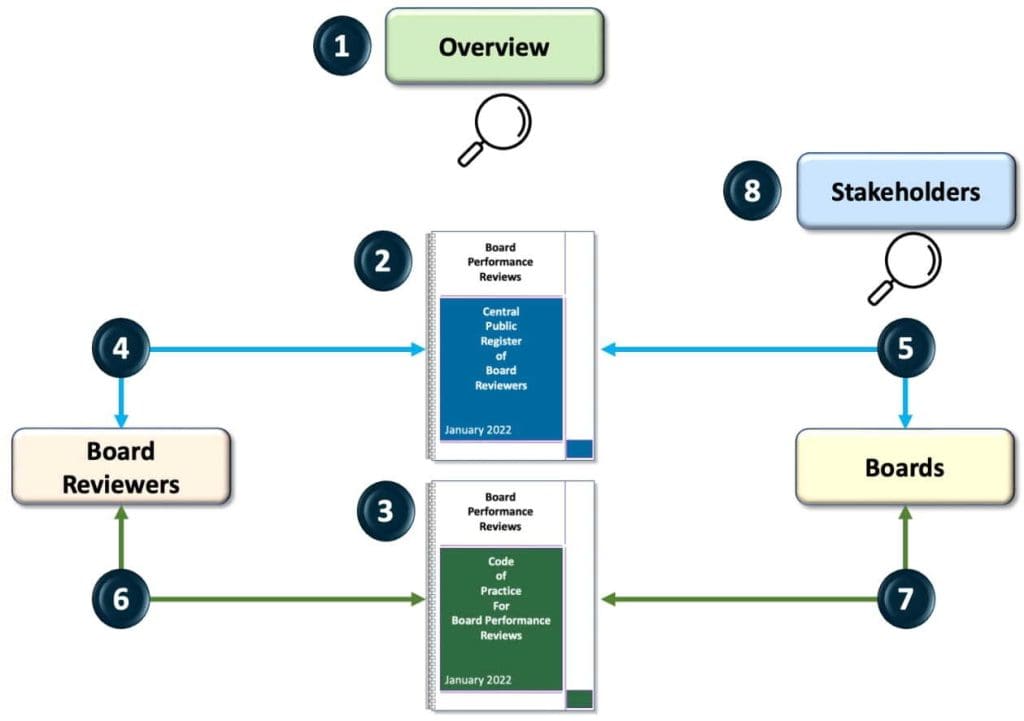

The Code of Practice – General Overview

In summary consideration, there are three main areas to consider:

1. A. The Code of Practice – Board Performance Review Principles

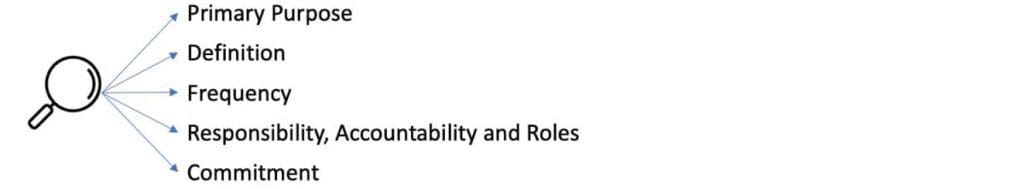

These address in overview:

Notably, the following comments:

A “Board Performance Review” is not defined to result in a prescribed methodology. Neither are minimum Reviewer qualifications prescribed. However, there is a “de minimus” definition that excludes those Reviewers supplying Boards and or organisations “with software or other tools” that may be used “as part of its internal review”.

Board Performance Reviews, in broad terms and current best practices, should be undertaken annually, with an independently conducted review every third year.

Both Reviewer and Board commit to and uphold the Code of Practice Principles.

1. B. The Code of Practice – General Principles

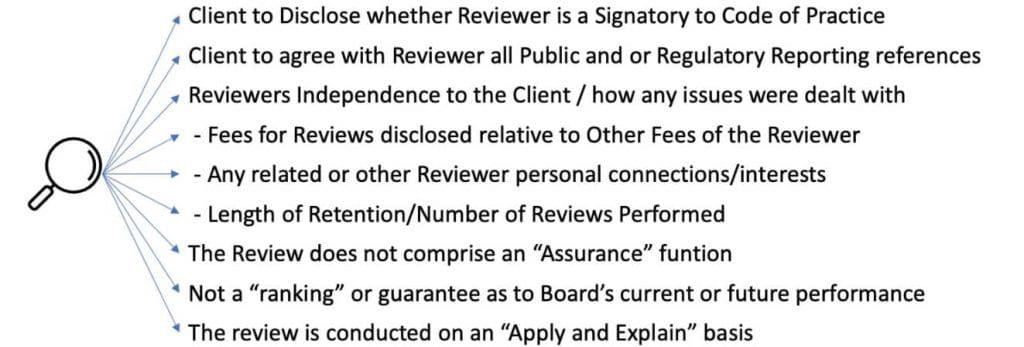

These address in overview:

Notably, the following comments:

Transparency is of paramount concern and focuses on two matters:

- There should be transparency over the process by which the Reviewer was selected, how the Board evaluation was conducted, the nature and extent of the Reviewer’s contact with the Board and individual directors, the outcomes and actions taken, and how it has or will influence Board composition and performance.

- There should be transparency over the agreement between the Reviewer and Client regarding the issues to appear in the annual report or any Regulatory or other public reporting.

2. Board Reviewer Principles

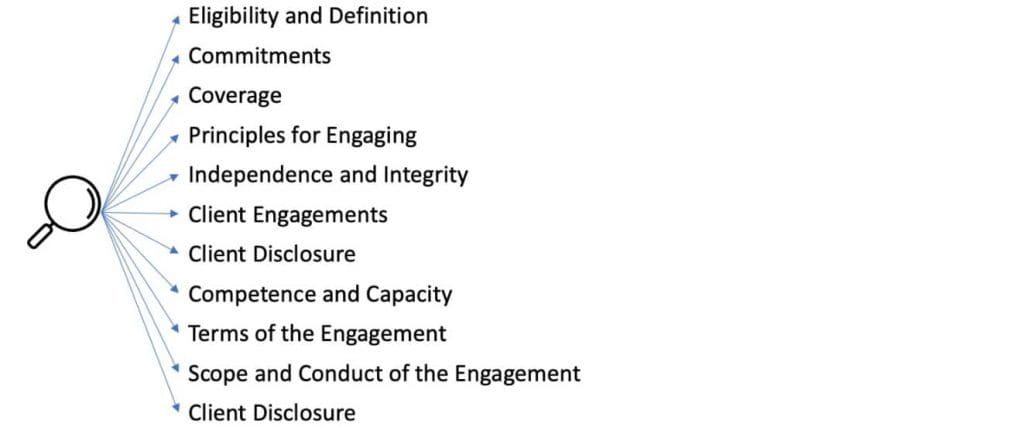

These address in overview:

Notably, the following comments:

The Board Reviewer must take a public position once ratified and committed to the Code of Practice. The above terms should comprise public declarations (website) and form the engagement basis (Engagement Letter), addressing each aspect related to the Code of Practice, acknowledging the Client’s specific needs underpinning the Engagement requirements.

From a practical perspective, the Engagement Letter should address aspects including:

- The Clients identity, lead contacts and process for consultation between parties.

- The identity of a key person for discussion of confidential matters (whistleblower etc.)

- Agreement on the process to deliver the engagement; access to people, information and other resources; the process by which the Board will receive and review the Engagement Report, including notifying the Reviewer of annual reporting and any Regulatory or other public reporting and the arrangement for and obtaining the Reviewers advance comments on disclosures.

- Agreement on deliverables, timescales, remuneration and timing, and out-of-pocket expenses.

- Arrangements, where appropriate, for follow-up work, discussions and or twelve months progress review and report back.

- Confidentiality Agreement and its scope, covering the assignment and any post work.

- Arrangements to cater for the Reviewer’s “insider status” during the review and any obligations.

- Among others.

3. Client Principles

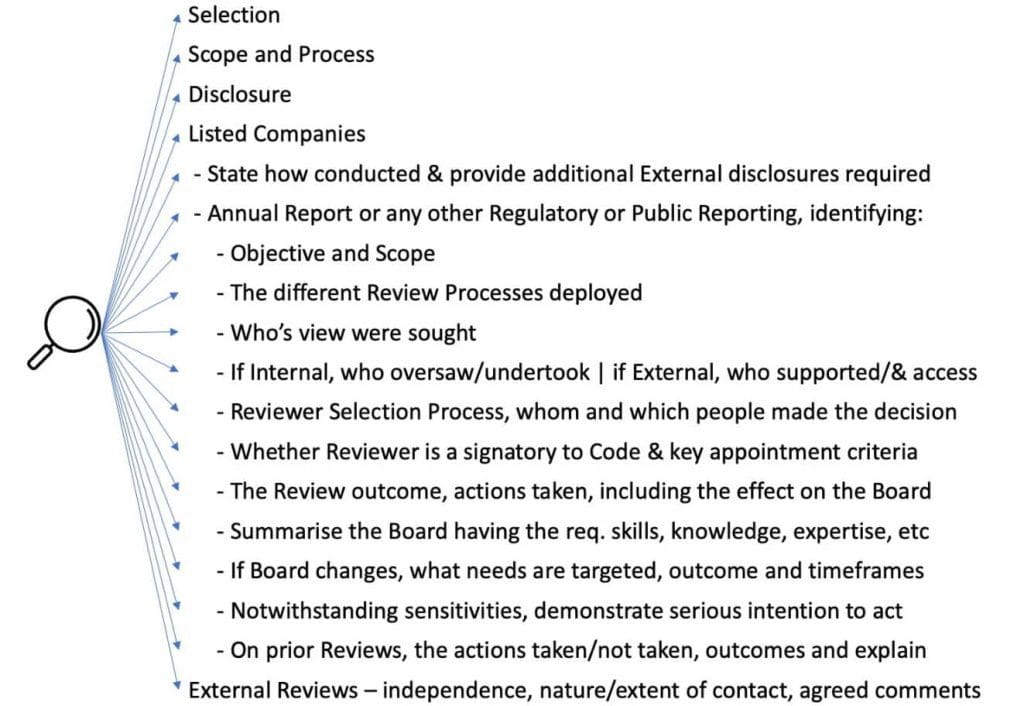

These address in overview:

Notably, the following comments:

The selection process should not be delegated to the decision of a single Board member or employee but ratified by an appropriate grouping and or its key representatives. The selection should exhaustively ensure its work to address independence and conflict is thorough and record any such and the steps to manage them. Additionally, the length of time of association with the Reviewer and engagements undertaken should be appropriately reviewed to the same ends, including the review of the Reviewer’s Fees and position relative, if it exists, to Other Fees.

The Engagement should allow the Reviewer to have access to and address the entire Board and engagement recorded access to key engagement contacts, people, information, and resources deemed necessary to undertake the engagement.

Of key focus is ensuring that the engagement process matters highlighted, progress in a transparent manner through to prior agreement between the Reviewer and the Client, before concluding any annual reporting and or Regulatory or other public disclosures.

Concluding Comments

The framework is excellent, addresses thoughtfully the aspects that surfaced before and as a result of the review and is nicely balanced, recognising a developing market that, if appropriately managed and guided, has much to offer Boards and their organisations to improve their respective performance. Similarly, it affords Board Reviewers a solution framework that encourages new and varied players, improvements in professionalism and market recognition of the valuable role provided while broadening market profiles, opportunities for innovative approaches and Reviewer driven solutions to meet differing client needs.

The sensible framework requirements, its mutually reinforcing components without Regulatory oversight and a light-touch approach, should be welcomed and rewarded through Board Reviewer and Board adoption of the structured voluntary solution, not only in its home market but adopted globally by all Reviewers and Boards serious about and seeking improved Board and organisational performance.

I thank you for taking the time to read this article and trust that in accordance with our GRC Consulting ethos, it is:

Simple to understand, Simple to implement and Simple to use.

If so, I would be grateful if I may ask of you the following:

1. Share the article on LinkedIn or wider to your fellow Board members, senior executives and company secretaries so that this may be read by more people with the expectation of spreading this positive development and adoption by Boards and their organisations.

2. Like and Comment on LinkedIn, and I am happy to address your comments.

3. Follow on LinkedIn, as I will be writing articles regularly that I hope are of value.

4. Obtain – if you would like to obtain a pdf copy of this article, together with the underlying central ICSA – January 2021 Final Report, then please click on the link provided directly below, enter your details and in the “Your Request” dialogue box, enter “Board Performance Reviews”. I will include a value-add document for your Board / informing your Board Performance Review process.

5. Link – https://grcconsultingltd.com/contact

Yours sincerely,

Bibliography:

1. ICSA – January 2021 – Final Report – “Review of the effectiveness of independent board evaluation in the UK listed sector”

2. FRC – July 2018 – “Guidance on Board Effectiveness”

3. FRC – July 2018 – “the UK Corporate Governance Code”

Note: Article items in quotations generally denotes extracts from the above, in particular the ICSA – January 2021 – Final Report