Board Performance Reviews

Factors to Consider – as a Board or Service Provider.

Gavin Wehlburg, Managing Partner, GRC Consulting

We focus on solving complex problems for Boards and Executive Leadership

utilising our creative skills, methodologies and technologies.

Published, July 2022. The views expressed are personal and my interpretations.

We set out in this article a simplified overview, with key messages and takeaways, addressing the “Factors to Consider” for Board Performance Reviews, either as a Board or Service Provider, that is also relevant reading for executives, board secretaries, and other interested governance readers.

Simple to understand, Simple to implement and Simple to use. – #GRCConsulting

As the heading suggests, based on “understanding the new direction” for #BoardPerformanceReviews for #Boards and their #Directors, covered in my prior LinkedIn Article, which may be read at:

Now that you have arrived at the point of addressing the Board Performance Review, the critical question becomes, “well, what now, and how to progress to ensure the best benefit to the Board and organisation”?

As no Board is equal/similar, one has to consider the Board within an appropriate framework and determine within a myriad of factors: what is relevant for that Board and its Directors; where is it placed in positioning for and successfully delivering on adding long-term sustainable value; current understanding and information available; the organisation, Board and organisation performance and its place within its business environment; etc.

Simply put – How “good” is your Board on the Performance Spectrum? and, as a direct consequence, positioning the Board appropriately for a Board Performance Review.

Board Maturity Considerations:

Some views to consider on Board “maturity” relative to Board Performance Reviews, where relevant examples, portrayed over a “development timeline”, are illustrated as follows:

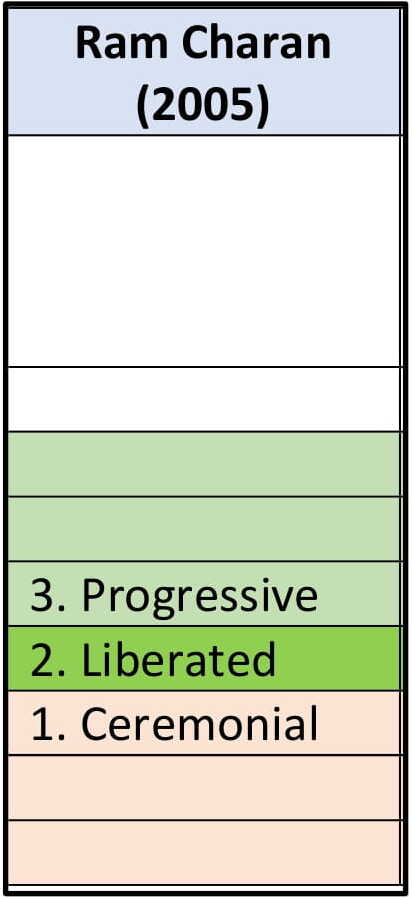

Ram Charan (2005):

1. Ceremonial – where the Boards primarily performed a compliance role; Director appointments prestigious with little communication between them or with the CEO and executive team, let alone wider; Fulfilled their explicit obligations, attending required meetings and “rubber stamping” management’s resolutions; largely anonymous to the public, rarely publicly reported and little risk or personal threat.

2. Liberated – mid-1990s and Post Sarbanes-Oxley; Boards expected to actively contribute; Directorship mandate expects active participation, contribution, and mindset; Positions including that of the Chair under pressure and voting for replacement; wide Board and governance reforms, with significant corporate scandals; Governance practices impacting share and corporate pricing; Activist calls being heard and Directors and CEOs pushing change, sometimes in an uncoordinated way destroying value, being ineffective, lacking focus; tenures become limited, particularly CEO’s.

3. Progressive – Meticulous legal compliance and in spirit; Team player uniformity, adding value whilst being unique and independent; Active contribution, dialogue, and focus on key issues to reach consensus and closure, eliminating the irrelevant; Individual challenge whilst maintaining Board harmony and without the CEO which energises Directors and provides stimulus and growth, individually and as a Board; Constructive working relationship between Board and CEO, with a confrontation of the thorny issues; Effective leadership at Board level, through working groups’ appointment of SID’s/Corporate Secretary, collating opinions to consensus of Board views constructively communicated with follow-up, collaboration and sincere implementation; adding value paramount and on many levels; Diversity of perspective and thinking, free flowing contributions with added value through their judgements on and suggestions for the CEO and his direct reports; Boards becoming a competitive advantage in and of themselves.

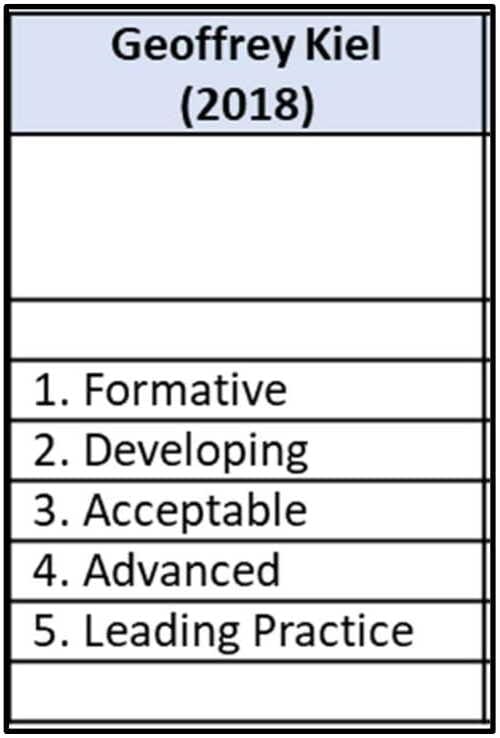

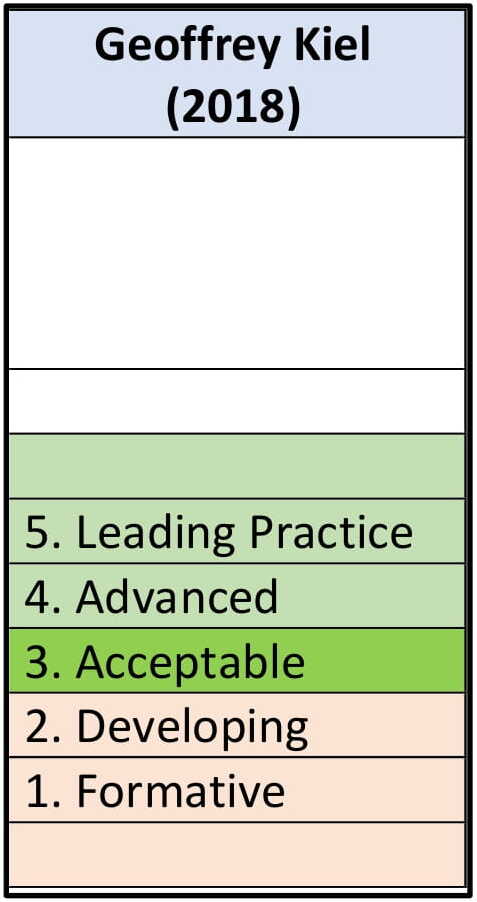

Geoffrey Kiel (2018):

1. Formative – Where development generally, in particular, governance is not formed or poorly evident and functioning.

2. Developing – Initial governance is evident, including measurement and improvement processes.

3. Acceptable – Minimum level of adequate governance is evident and functioning.

4. Advanced – Governance practices are evident that exceed minimum acceptable levels.

5. Leading Practice – Independent consensus of governance frameworks performing at best practice levels.

Without “code jargon”, Boards are appointed to assure the organisation’s and its environment’s long-term sustainability and success. The Board comprises the most powerful player within the organisational structure, fully responsible and accountable. The Board is the “guardian” or “steward” of the organisation’s future.

Therefore, the Board is responsible for Performance. It has to perform, contribute, add value, progress, improve, and ultimately ensure that the future is better than today.

In our view, the overwhelming focus is on “Performance”, and we view and position our Board Performance Reviews around the core issue of Performance for those able to and aspiring to play the game of business at the highest levels. When utilised in Board Performance Reviews, we see this focus as superior, beneficial, and adding greater value.

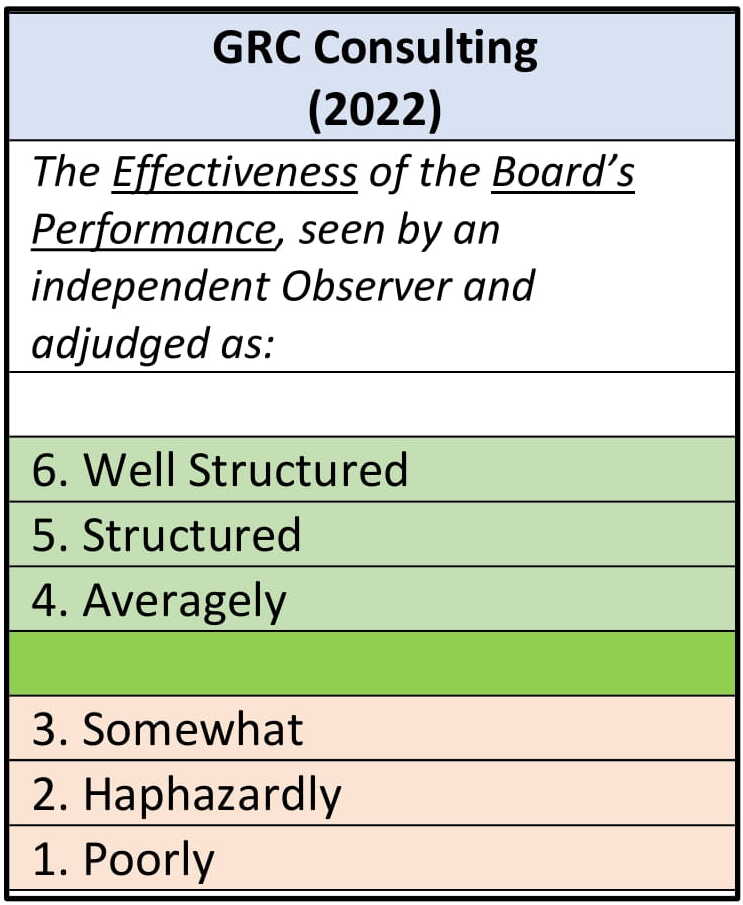

GRC Consulting (2022):

Our model uses the criteria of considering “The Effectiveness of the Board’s Performance, seen by an independent Observer and adjudged as”:

1. Poorly – being “Poorly effective/supportive” – as a consequence, not effective and does not deliver the desired results.

2. Haphazardly – being “Haphazardly effective/supportive” – as a consequence, giving rise to unpredictable effectiveness and delivery of desired results.

3. Somewhat – being “Somewhat effective/supportive” – as a consequence, somewhat effective or marginal in delivering desired results.

4. Averagely – being “Averagely effective/supportive” – as a consequence, averagely effective in delivering desired results.

5. Structured – being “Structured effective/supportive” – as a consequence, demonstrating acknowledged effectiveness in the delivery of desired results.

6. Well Structured – being “Well Structured effective/supporting” – as a consequence, activities are embedded with proactive effectiveness in delivering desired results.

We also endeavour to anticipate human nature, and our models do not, where possible, facilitate participating Boards and their Directors to “sit on the fence”. We, therefore, adopt a 1 to 6 rating, in preference, over comparable 1 to 5 models.

From the many Boards, their Chairs, and Directors that we interact with, you will quickly develop a sense of and be told the “gut feel positioning” and derive an understanding of the positioning of the Board and its respective performance.

While the models above help further develop these “gut feel” viewpoints with more “concrete” and evidentiary information, the considerations are more complex and require additional “lenses” to view the positioning for a Board Performance Review concerning other practical considerations.

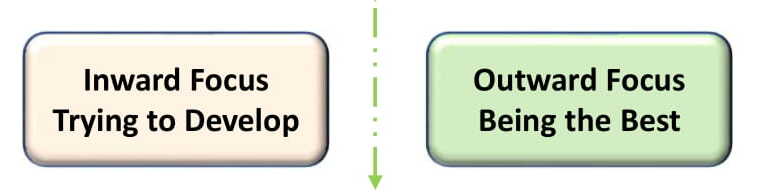

Performance Mindset: First, let us develop and focus on a “performance mindset” as we advance this discussion. Consequently, let us also endeavour to see the above models in this same light, reframed as follows:

Definition – Board Performance Review:

Second, before preceding further, it is essential to clarify more explicitly at this stage what this article is focusing on when it uses the terminology “Board Performance Review”, thereby further assisting in understanding the positioning for a Board Performance Review.

By definition, the terminology is in the context of “Independently” performed/facilitated “Board Performance Reviews” and in its broader sense, refers to a “full scope” “Board Performance Review”. Generally taken at a best practice level to incorporate the following:

1. Onsite component, which may be performed by Board Reviewers, comprising independent, professionally qualified personnel conducting this component of the review exercise. Typically, inclusive of those Board Reviewer processes to “see first-hand”, corroborate, meet, and discuss in person to evaluate, assess, and conclude, and other similar activities, facilitated by the Board Reviewer being onsite, in-person, and interacting on a personal level with members of the Board and related persons.

2. Information Gathering component, which may be undertaken by:

a. the above independent, professionally qualified personnel or Board Reviewers.

b. It may be performed by the Board using other service providers with electronic or other information gathering methodologies and or tools.

c. It may be completed by various other means or by the Board or organisation itself.

Board Performance Reviews, while currently not being explicitly defined, to allow greater market freedom and choice among a range of other factors, are, however, expressly noted as a “de minimus” definition to exclude any “Board Performance Review” that has software or other tools supplied to the Board and or organisation that is then used by the Board and or organisation as part of its internal review.

The primary purpose of regular Board Performance Reviews is to help the Board continuously improve its performance and that of its organisation.

The continual process of self-improvement may include making changes to the Board.

Reported disclosures should provide evidence of a robust methodology and a willingness to act on the outcomes. By doing so, the Board can reassure shareholders and other stakeholders that it takes its responsibilities seriously and endeavours to carry them out to the best of its ability.

Engaging an independent Board Reviewer can bring greater objectivity and fresh insights to the process and reassure the organisation’s shareholders and other stakeholders that the Board and organisation take their responsibility for continuous improvement seriously.

Board Performance Reviews, under many global and or leading corporate governance frameworks, are required by market best practices and or Regulators and similar to be conducted:

- Continuously, therefore annually and internally, and

- Independently led by an appropriately independent and professionally qualified Board Reviewer every third year.

The Board should ensure that to undertake an Independent Board Performance Review, it understands and clearly delineates the distinctions between the two components comprising a full scope Board Performance Review. Namely:

- Onsite Component.

- Information Gathering Component.

The Board should, in properly undertaking a full scope and Independent Board Performance Review, engage in both components within the full scope of the Review.

The Board may decide to adopt or to contract with Service Providers who do use software or other tools as part of an “external and independently provided Board Performance Review service that results in defined client deliverables and reporting”, which may or may not include onsite visits and or interviews with relevant persons, subject to the scope of the Board’s engagement. However, the Board should not subscribe to and or engage with any Service Providers with software or other tools solely provided for the Board’s use in what would constitute an “internal review”.

It is recognised that electronic or other information gathering methodologies and or tools are not only currently globally preferred but provides valuable, practical and cost-effective, and efficient methods within the Information Gathering Component. However, to undertake a full scope and Independent Board Performance Review, the Board, must also engage a Board Reviewer service provider to address the Onsite Component.

The Board should consider these constituent components carefully to ensure that it obtains the best and most appropriate combination to suit its current needs and ensure the attainment of the primary objectives of the Board Performance Reviews, namely to:

- Assist the Board in continuously improving its performance, and

- Continually improve the performance of the organisation.

Board and Organisation Context:

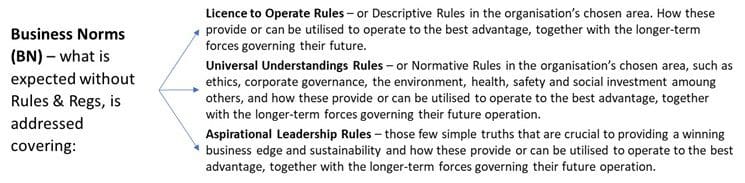

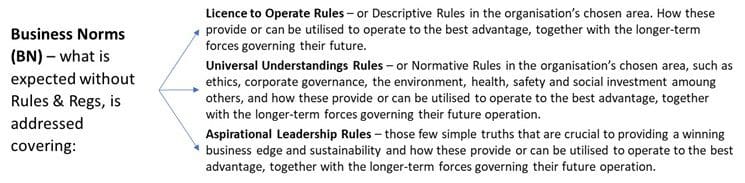

Third, and moving the discussion forward regarding understanding the positioning for an Independent Board Performance Review, it is also crucial to understand and appreciate the context within which the Board and organisation operate. Namely, the law (legislated and the “rules” of business”) and applicable Corporate Governance frameworks, mandatory and otherwise, which by their nature place dictates on the Board and organisation, thereby impacting considerations in respect of an Independent Board Performance Review.

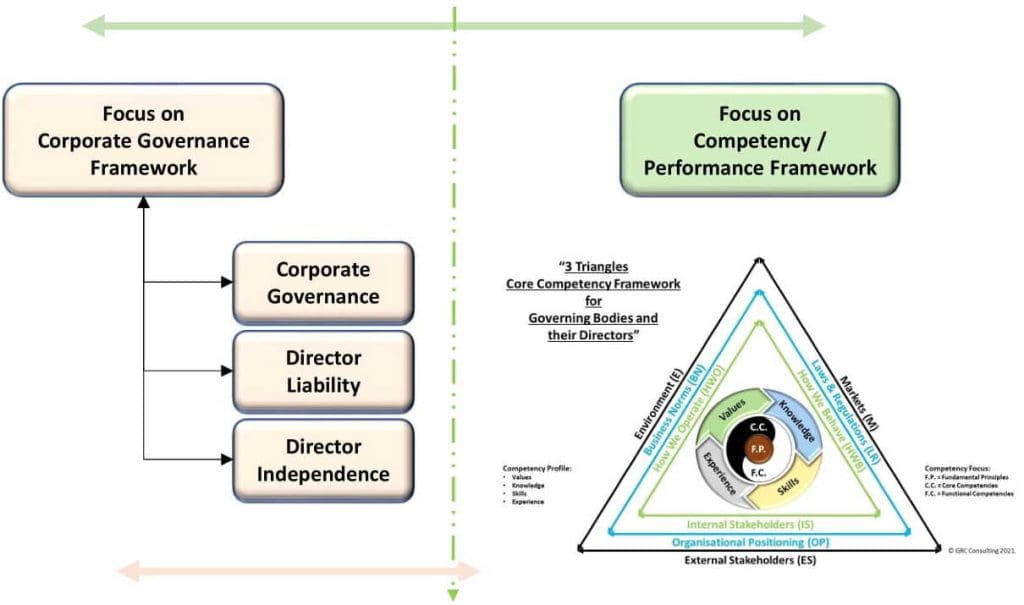

Conformance versus Performance:

These considerations develop and inform our next model to illustrate the factors as follows:

While reality is often a balance, it is essential to ensure that that perspective is also balanced. As we are constantly reminded, “one has to be able to walk before running,” and in the case of Board Performance Reviews, “its horses for courses” or, more succinctly, it is crucial to ensure that we understand the Board’s proper positioning and apply the correct Board Performance Review approach according. The above illustrations, in this context, therefore, serve a very valuable purpose.

Further, a “balanced perspective” must consider that a Board will not likely fit perfectly into one or the other tracks, being “Conformance” or “Performance” oriented. It is therefore vital to determine clarity on the “balance” of the Board’s positioning.

Board “Conformance” Positioning:

In considering the “Conformance” positioning, we have summarised, through the various maturity models presented, that an indicative Board would exhibit the characteristics of:

1. Ceremonial to 2. Liberated

1. Formative to 2. Developing to 3. Acceptable

The Effectiveness of the Board’s Performance, seen by an independent Observer and adjudged as:

1. Poorly to 2. Haphazardly to 3. Somewhat

They would tend to focus on “Conformance”, be all about compliance, with that focus centered around compliance with their respective Corporate Governance framework.

This would therefore find that their focus, driven by their respective Corporate Governance framework, to be centered around:

1. Corporate Governance – developing and attaining compliance with the framework’s various sections and their individual requirements.

Note: Leading Corporate Governance frameworks require, in addition to the often broad-ranging scope of compliance and requirements of the Board and its Directors, to implement and achieve by way of structures, processes, controls, and other operational aspects, to conduct Board Performance Reviews:

- Continuously, therefore annually and internally, and

- Independently led by an appropriately independent and professionally qualified Board Reviewer every third year.

2. Director Liability – endeavouring to ensure that their Directors understand the scope of their personal Director oriented risk/personal liabilities arising from the law and Corporate Governance framework’s various sections and their individual obligations.

Note: Leading Corporate Governance frameworks, by their very nature, give rise to a range of personal liability risks for the individual account and responsibility of every Director. This is not to be confused with Board risk or organisational risk of various forms – this is personal and for every Director to ensure compliance and should be assessed at minimum annually.

3. Director Independence – endeavouring to ensure that their Directors are and are seen to be independent in their positions on the Board, personally and in conduct of business.

Note: Leading Corporate Governance frameworks, by their very nature, require an annual Independence Confirmation from all Directors to ensure that there are no relationships or circumstances that affect or may affect either a Director’s independence or, collectively, that of the Board. Best Practice further dictates that each Board should actively consider in advance the nature of the matters to come before it and where these would be “judged by the normal person” to be material to the business of the Board/organisation’s interest, then a separate position of independence should be sought of all Directors for the Board collectively. Further, this may require to be sought both specifically and generally, depending on the circumstance.

From the above, we are therefore able to conclude that following a “Conformance” track positioning for a Board, that a Board Performance Review should consider, among other matters, addressing the following three elements within the scope of its work:

- Corporate Governance Review

- Director Liability Review

- Director Independence Review

to meet the minimum “threshold level” being driven by leading Corporate Governance frameworks.

While both the Director’s Liability and Directors Independence Reviews are both somewhat explanatory, relatively simpler to understand, and driven by the specifics of the respective Corporate Governance framework, and consequently, will not be addressed in more detail within this article, it will be helpful to focus on a generic mapping of the requirements of a Corporate Governance Review, to assist in the understanding of positing for a Board Performance Review, notwithstanding that all three may well be and often are, mandatory requirements of the Corporate Governance framework or related regulatory authority.

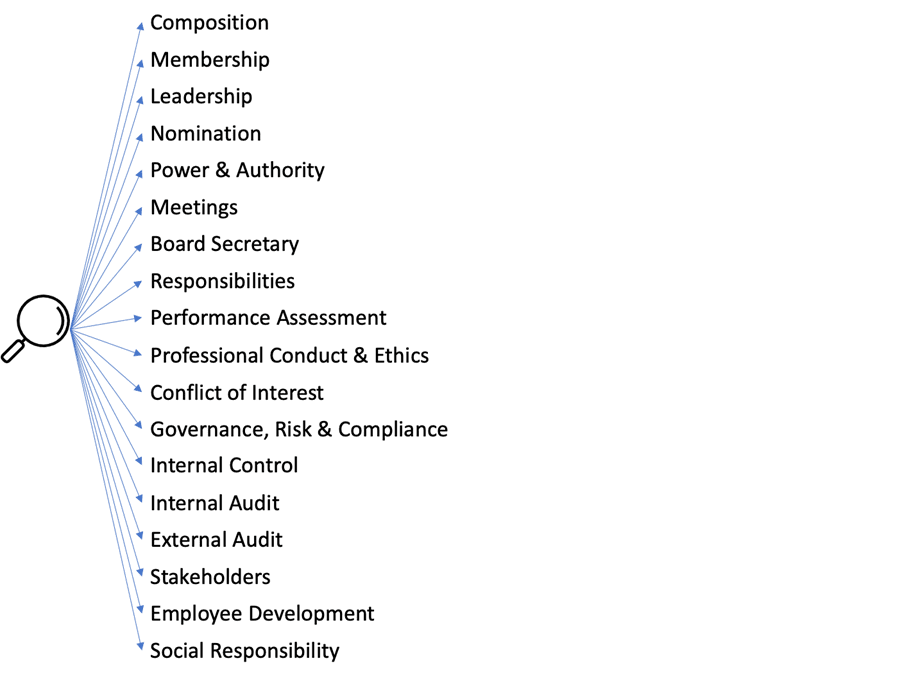

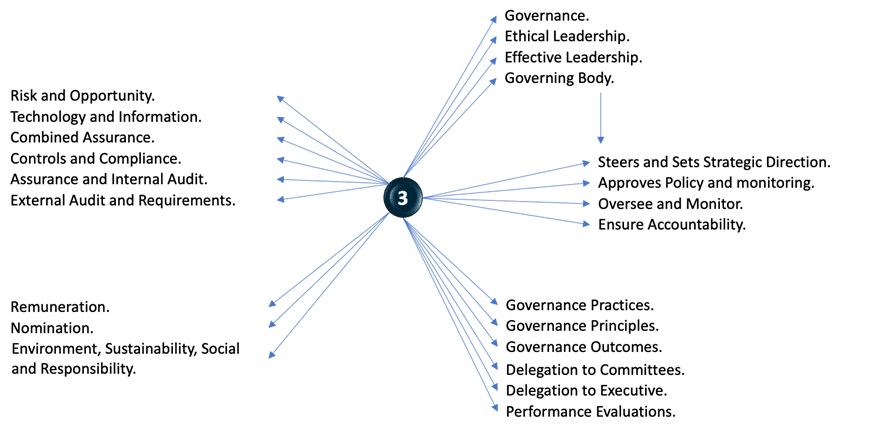

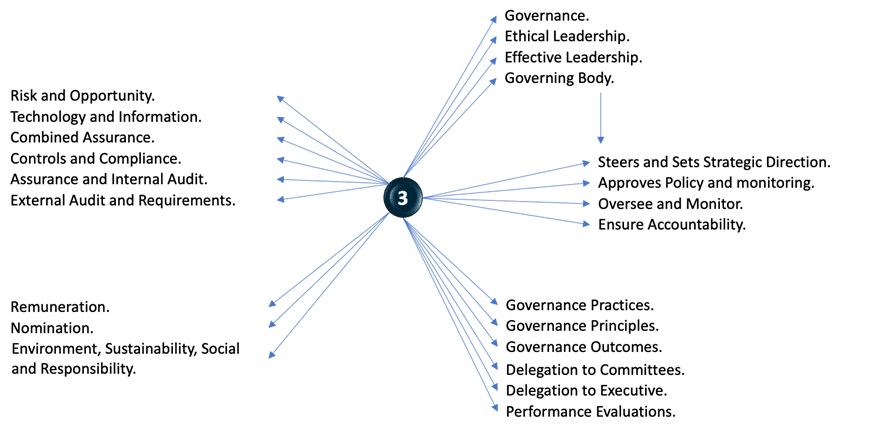

Illustrative Board Conformance Corporate Governance Framework:

Note: The following categories and or sub-categories are illustrative and are not intended to be fully comprehensive, simply illustrative. While they have a foundation in existing Corporate Governance frameworks, they have been re-organised to simplify what is often more complicated than necessary into easy reading and comprehension for readers. Also not shown are the specific line-by-line detailed Corporate Governance framework statements and their requirements. Please read accordingly.

1. Individual Director.

2. The Board.

3. Board Committees.

4. Shareholders.

5. Disclosure, Transparency, Reporting & Retention.

Notes: It is important to appreciate the following:

1. Regulators, Authorities, or other bodies responsible for Corporate Governance frameworks, operate on cycles from the perspective of issuing and then refreshing their frameworks. Consequently, while every effort is assumed, it does not necessarily ensure that the respective Corporate Governance framework is current or represents best practice. By definition, the Corporate Governance framework should be considered the minimum level of compliance or aspiration for any Board.

2. Boards, in contrast, while adhering to Corporate Governance frameworks, whether compliant at a minimum level or not, are free to adopt current best practices.

3. For the above framework illustrations in this article, we have focused on the “Information Gathering Component” and the Corporate Governance framework and related requirements. It should be appreciated that while this may be appropriate for certain “Conformance” positioned Boards and that Board should “gather information” before making informed decisions, a Corporate Governance oriented Board Performance Review can still and very easily be combined with other components to either cater for a specific Board need or to broaden the exercise to provide additional helpful decision-making information.

4. It is useful to step back from the detail and review the above illustrative Corporate Governance framework categories and sub-categories, reflect on current global governance and related trends, and then note what may be considered to be missing? For example, where is ESG – Environmental, Social, and Governance, clearly we have the Governance element.

At this point, I trust that readers are discerning the thrust between the key contrasts within this article, namely the difference in positioning between those Boards that are “Conformance” positioned versus those Boards that are “Performance” positioned.

The last Note point directly above is illustrative of this difference and would lead to the conclusion that such a Board with base level compliance and higher aspirations may be better served by a Board Performance Review that is “Performance” focused.

In determining this position, it should be appreciated against this backdrop of leveraging “Performance”, that the Board still has to demonstrate that it is compliant from the “Regulatory Corporate Governance” perspective.

For this reason, GRC Consulting recommends that those regulated Boards and their Directors, who are not at or have a concern as to the level of their Board’s and or individual Director’s Regulatory Corporate Governance Compliance, that as a process of maturity development and compliance positioning that they incorporate into their Board Performance Reviews, a program that is more appropriately focused upon addressing their respective Regulatory Corporate Governance positioning first.

Once this is addressed and the Board and its Directors have a clearly demonstrated and satisfactorily adequate Regulatory Corporate Governance compliance position, the focus can shift from “Conformance” to “Performance”.

It is now appropriate in this article’s discussion to switch focus to a “Performance” oriented Board Performance Review and highlight the relevant factors for consideration.

Illustrative Board “Competency”/”Performance” Framework:

In considering the “Performance” positioning, we have summarised, through the various maturity models presented, that an indicative Board would exhibit the characteristics of:

3. Progressive

4. Advanced to 5. Leading Practice

The Effectiveness of the Board’s Performance, seen by an independent Observer and adjudged as:

3. Averagely to 4. Structured to 5. Well Structured

They would tend to be focused on “Performance”, be all about Competence, outward focused, with the mindset and drive to continually be the best, with that focus centered around Competence / Performance with their respective framework, which has been developed to suit the achievement of their purpose and long term sustainable vision.

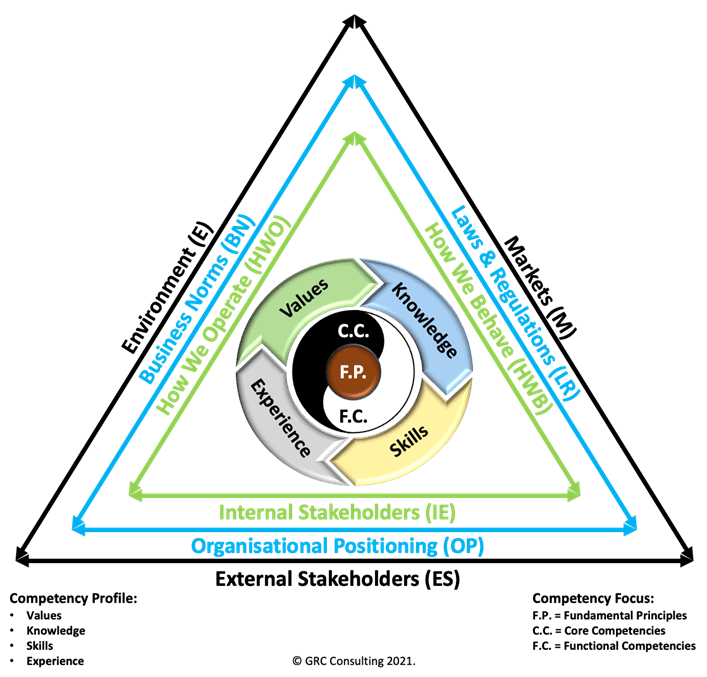

To illustrate a “Competence/Performance” framework, we will utilise the GRC Consulting proprietary © GRC Consulting model.

GRC Consulting and its “3 Triangles Core Competency Framework for Governing Bodies and their Directors”, words, diagrams and associated logos are Trademarks. All rights are reserved to GRC Consulting. No reproduction, modification, or use in any form may be undertaken without the written permission of GRC Consulting.

“3 Triangles Core Competency Framework for Governing Bodies and their Directors”

At first glance, the reader should clearly discern that this is not an inward, compliance-focused framework. It is worldly, globally, outwardly focused, considerate of the environment, social, markets, and business placement of the organisation, yet comprehensively linking the outside world, through its relevant laws, business norms, and strategy, to the inner workings and structures encompassing “How We Operate”, “How We Behave”, and it’s Internal Stakeholders, required by high performing Boards and their organisations, with a central focus on the Board and its Director’s respective “Competency Profile” and “Competency Focus”.

GRC Consulting firmly believes that to be of true value to Governing Bodies and Directors, the Competency Framework must be as practical and oriented to working life as is possible.

It must take the perspective of the director sitting behind the desk, facing real life, having to consider and do the things that governing bodies and their directors have to do, that they have to deal with.

This would therefore find that their focus, driven by their respective Competency / Performance framework, be centered around:

1. Competency – External Business Environment.

We constantly monitor and record the most important matters being considered, debated, and reported on globally, such as from Davos, World Risk Institutes, Global Governance, Director Forums, Thinktanks, Leading Consultancies, News, and others, tabulating the Top Issues facing Governing Bodies and their Directors.

We update our Methodology to reflect these as the top key global matters that, as Governing Bodies and Directors, we expect you to be conversant with and ensure an appropriate Spread across a PESTLE Framework and Markets.

Environment (E) and Markets (M):

External Stakeholders (ES):

We consider the current Best Practice Governance approach, processes, and Public Reporting requirements addressing External Stakeholders.

2. Competency – “How Best to Play the Game of Business”.

The scope of Laws and Regulations (LR) is addressed across an understanding covering:

We cover Market Leadership through Customer Value Focus and Organisational Positioning (OP) with understanding Strategy:

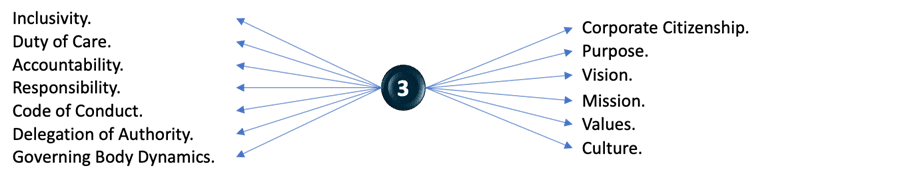

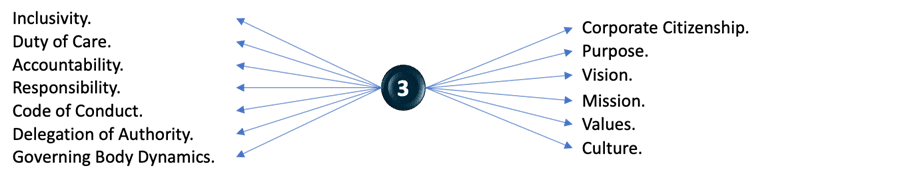

3. Competency – “How We Operate”/Behave/Stakeholders.

How We Operate (HWO):

We cover Best Practice expectations of Governing Bodies and Directors on:

How We Behave (HWB):

We cover Best Practice expectations of Governing Bodies and Directors on:

Internal Stakeholders (IS):

We consider the current Best Practice Governance approach, processes, and Public Reporting requirements addressing Internal Stakeholders.

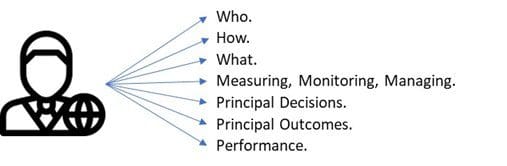

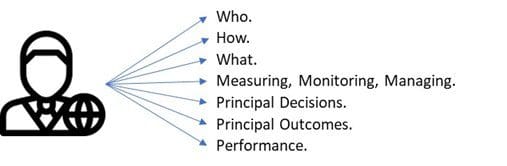

4. Competency – Competency Profile and Competency Focus Approach.

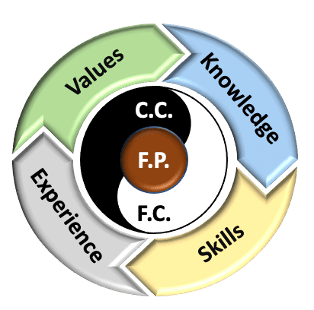

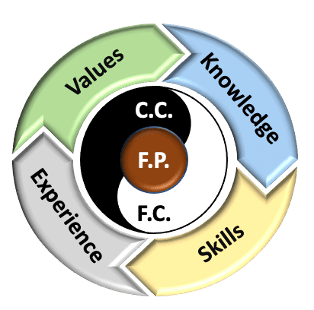

Our approach to assessing a director’s Competency Profile (Values, Knowledge, Skills, and Experience) together with Fundamental Principles, Core and Functional Competencies is founded on the premise that:

A director’s Competency Profile directly impacts any Fundamental Principles, Core Competencies, and or Functional Competencies, and why the model opposite shows the Competency Profile components “circled” around the latter.

Further, with respect to the Competency Profile element of “Skills”, which we designate as “ability to use their honed expertise” / the set of honed expertise bought to the table by the director and Core Competencies, it is not practical, given that each director/business/industry/etc.

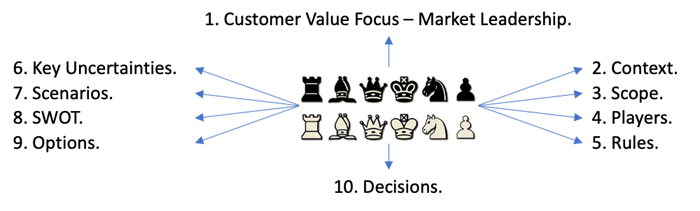

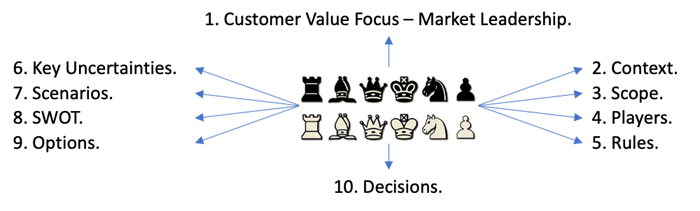

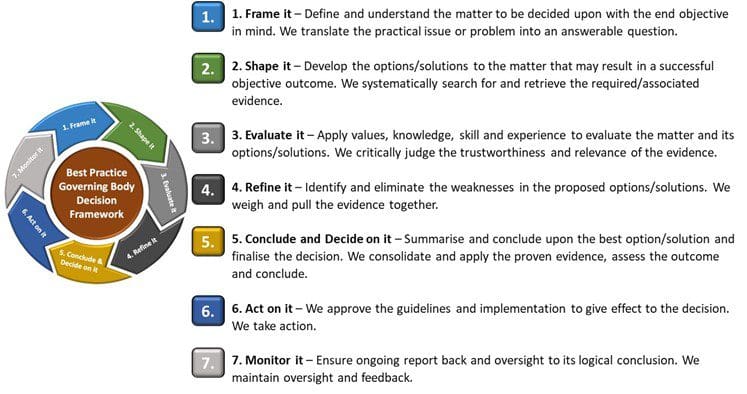

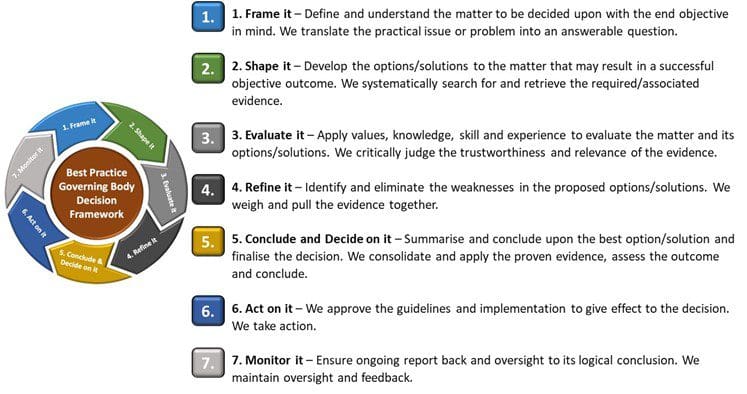

may drive specialisation to take a direct approach to “Skills” assessment for these obvious reasons and implications to efficient assessment. GRC Consulting focuses on “Performance” and, therefore, the consequent “director’s actions” aspect of the impact of these honed expertise. We utilise a Best Practice “Decision Framework” that governing bodies and directors may follow in conducting the governing body’s “business around the table” and taking action on requirements before the governing body to adopt a “Practical and Performance-Oriented” professional approach to these two areas.

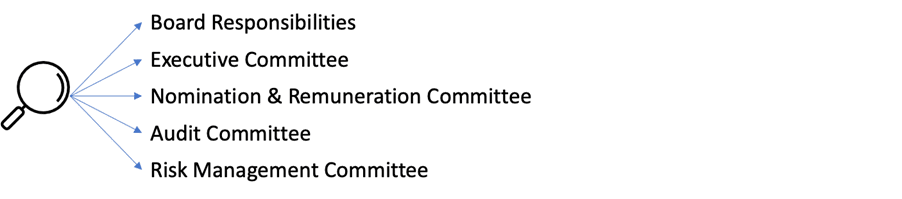

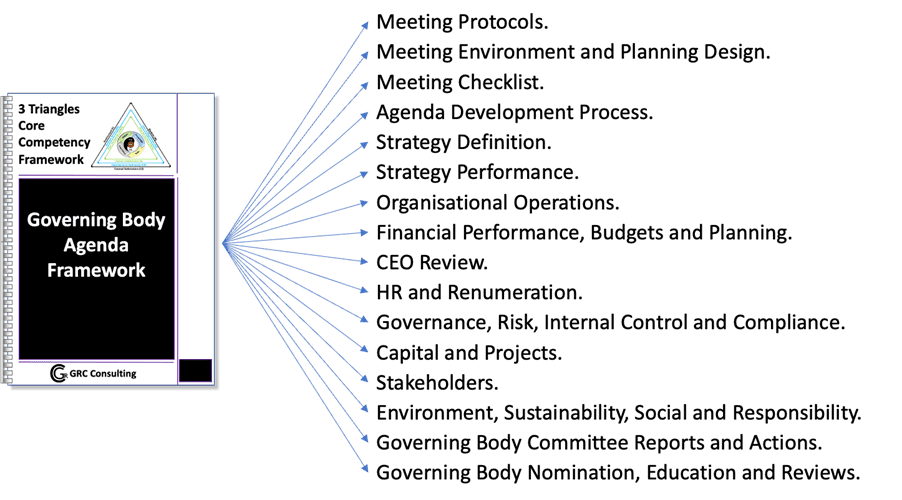

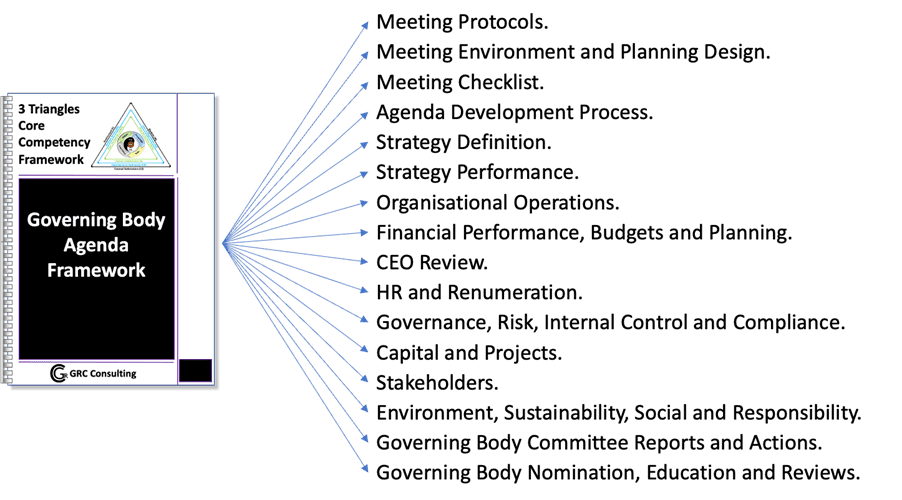

For Functional Competency assessment, we utilise a “Best Practice Governing Body Agenda Framework”, which includes the Best Practice Elements of: what High Performing Boards execute on; and what Best Practice Corporate Governance requires; in conducting governing body business and through these “functional” elements of what agenda business is undertaken to base the assessment.

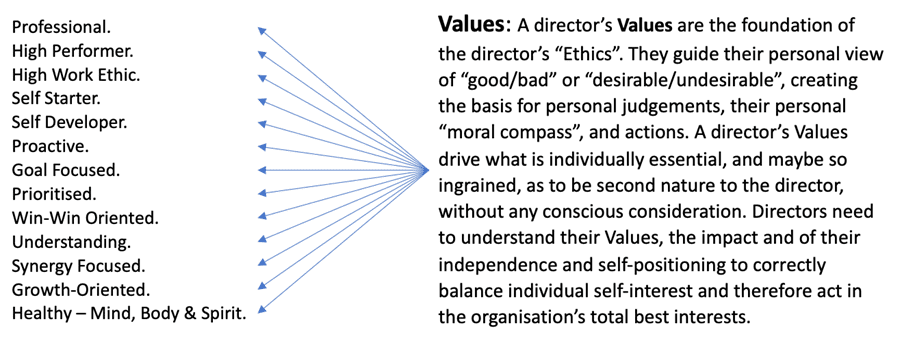

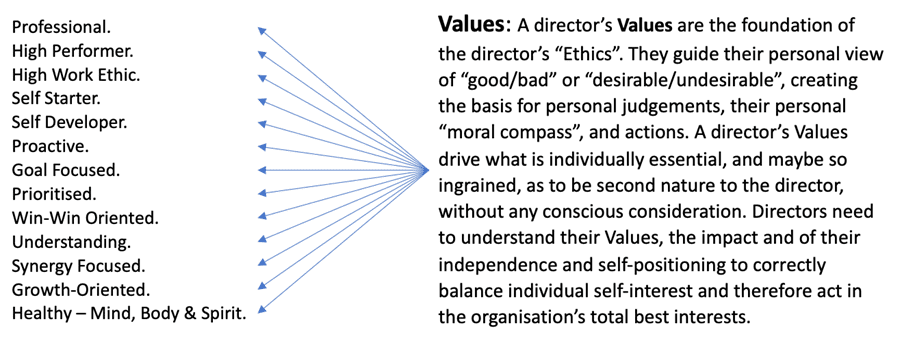

Values:

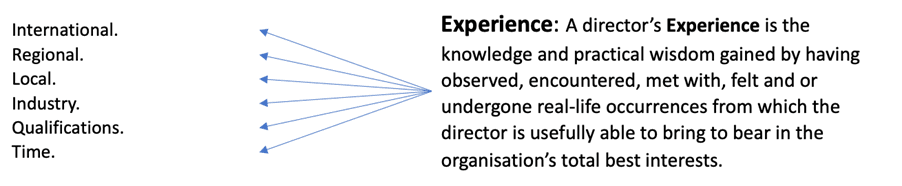

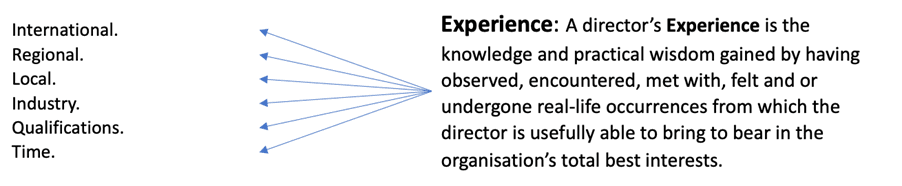

Experience:

Knowledge:

A director’s Knowledge is the director’s familiarity, awareness, or understanding of facts, information, descriptions, or skills acquired through their theoretical or practical understanding, experience, or education by perceiving, discovering, or learning from which the director is usefully able to bring to bear in the organisation’s total best interests.

We focus on performance. We view the greatest benefit to the governing body and directors where through this service, we leverage competencies and enhance collective capabilities through knowledge. We have collated Best Practices from Governing Body Dynamics, Corporate Governance, High Performing Governing Body, and Director Practices that focus on the Governing Body in action, as follows:

Skills:

A director’s Skills is their ability to use their honed expertise, talents, knowledge, and experience effectively and readily in executing and performing their mandate in the organisation’s total best interests.

We utilise a Best Practice “Governing Body Decision Framework” to address Skills and Core Competencies (C.C.):

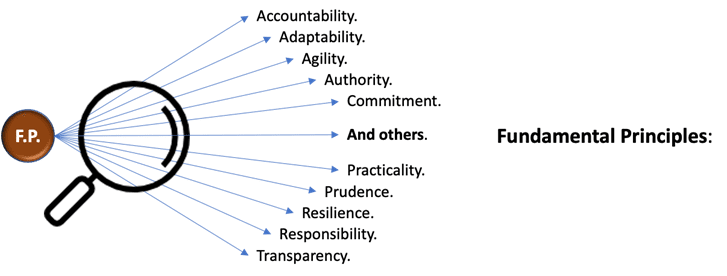

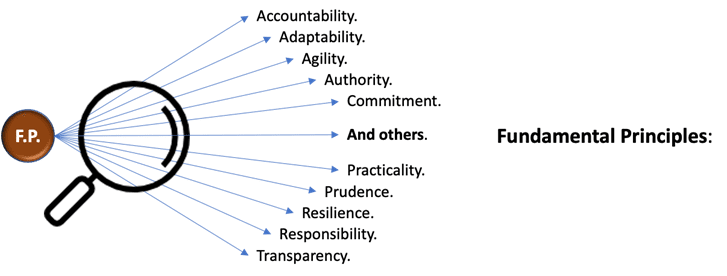

Fundamental Principles (F.P.):

A director’s foundational and internal theory, law, and or rules, guiding their behaviour, perspectives, and actions in what is right and wrong.

We focus on performance. We have used advanced searches on leading Governing Bodies, Directors, Corporate Governance, Past reported Governance Failures, Leading Director bodies, Thinktank Reports, and similar to extract the listing of a Director’s Fundamental Principles.

From this research, we have distilled the prioritised Listing of Fundamental Principles that Leading Practicing Directors should be consistent with, in their fiduciary and governing body duties, and incorporated them into our Competency Assessment.

Functional Competencies (F.C.):

A director’s Functional Competencies are the scope of those competencies defined by the duties, requirements, and responsibilities (“functions”) to execute the organisation’s mandate. These are the organisation’s general functional-driven requirements.

We utilise a Best Practice “Governing Body Agenda Framework”:

Board Leadership:

Board Performance Reviews require appropriate Board Leadership, increasingly as one progresses up the maturity development curve from “Conformance” to “Performance” and the need to approach these as a team to maximise the benefits for both the individual Directors and the Board as a whole, given the unquestionable role that Board Dynamics play in these areas.

The Chair, in particular, plays a vital role in progressing and overseeing the process, even when delegated to a committee or the Senior Independent Director (SID) – the Chair is the “steady hand at the tiller of the ship”. The Chair, in particular, should be and clearly be seen to be fully supportive and behind the Board Performance Review process and play a visible leadership role for all Directors and the Board and drive following review related change.

While we have only highlighted Board/Director participation and responses, one may also consider additional complexities: Chair Cross-reviews; 360’ Degree Reviews; Peer Reviews; Committee Level Reviews; and others, all of which add layers on top of a base review.

The right Leadership is also relevant to ensure that not only are the results appropriately dealt with to their logical conclusion, including change and reporting but also that implementation is appropriately managed to realise concrete results, improvement and performance.

Objectives – Moving from “Here to There to Make Decisions and Achieve Success”:

Whether it has undertaken a Board Performance Review previously or not, the Board should agree on a set of objectives to be accomplished and to ensure mutual support and effort from all Directors, who should have their debate and involvement in this process.

Where the Board has either conducted prior reviews or has identified matters to be addressed or generally or specifically has aspirations, targets, goals and similar, these should be worked through to a finite set of objectives. Even if that is simply that the Board has never undertaken these types of exercises and will be driven by an appropriate Service Provider to assist it, alongside their approach, methodology and experience to do so, mindful that an Engagement Letter should be in place to manage and guide an agreed-upon process.

Further, it is helpful for the Board to approach these matters in manageable demarcated stages, as doing so provides significant benefit and better results while managing budgets.

Ultimately the Board should be seeking improvement, irrespective of whether it is on a “Conformance” or “Performance” track.

To place itself in such a position, it needs information.

Information gathered by the Board Performance Review process then puts it in a:

- “consideration” and “decision-making” position,

- from which it can implement appropriately,

- achieve its objectives and related improvement and performance success.

From this perspective, the Board, in approaching these matters in manageable demarcated stages, should consider prioritising the activities of the Board Performance Review – “Information Gathering Component” ahead of the “Onsite Component”.

Additionally, in a world of limited or pressurised budgets, this enables the Board to more clearly see the results of the “Information Gathering Component” and to then focus down on the real issues surfacing, thereby allocating its financial and other resources to best effect, to the “Onsite Component”, which in the case of external facilitation as relatively the most expensive component, is best enabled to ensure positive and concrete outcomes.

Additional Benefits of Undertaking a Competency Performance Framework Approach:

Many factors can be featured in a Board Performance Review, and no Board is the same or equal!

The critical question is, what benefit can be derived from the Board Performance Review? other than the obvious, which we trust is already highlighted in the forgoing.

Generically, Boards can benefit further in the following areas:

Stakeholders – based on undertaking transparent reporting:

- Demonstrating that the Board takes its responsibilities for improvement seriously.

- Improves Trust by better marketplace governance, transparency and performance.

- Better Institutional and public investor engagement.

- Improvement in Board and organisational structure, processes, controls and policy.

- Helps establish the correct “tone” from the top for the organisation and Board respect.

- That the Board will not shy away from the difficult, making correct sustainable decisions.

- It sends the right message that the Board/organisation is focused on improvement/performance and expects the same from all its stakeholders in this leadership.

Board Performance – Competence and Competency:

The overwhelming majority of Governing Bodies today are under increasing pressure.

They are busy and have a full and increasing agenda. As a business imperative, they have to up their game. They have to improve Performance, do more with less, achieve greater and greater more efficiently, be more effective, reduce risk and obstacles, but above all else, improve their Performance. Stakeholders demand nothing less!

Competence – What are we talking about here? …

A Director’s Competence – is the individual ability (power, skill, means and or opportunity) to perform successfully and or efficiently.

Competency – The skill needed …

A Director’s Competency or capability (ability, aptitude or fitness) to apply and or use their set of related Values, Knowledge, Skills, and or Experience (Competency Profile) in the execution of their role as a Director.

It is therefore crucial, and why our Competency Framework is focused on Director Competence and Competency, so it is Performance oriented – Performance that is paramount in today’s highly competitive world and Boards.

The Competency Framework sets out in transparent reporting where each Director and collectively the Board is positioned, thereby enabling enhanced decision making on what may be required to improve Performance on each as we advance.

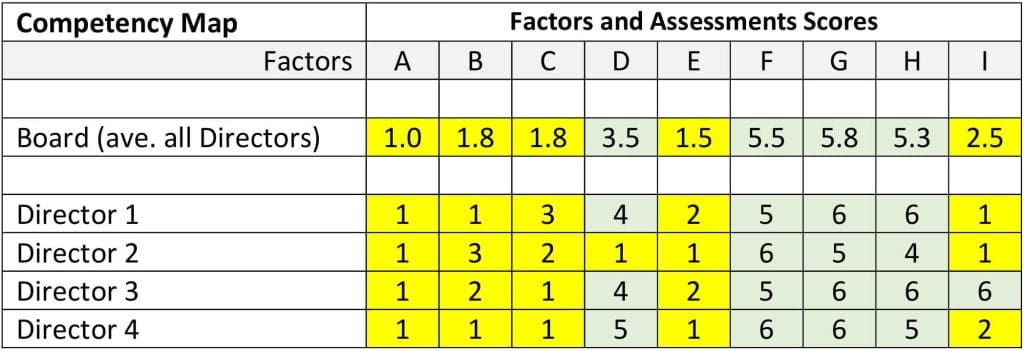

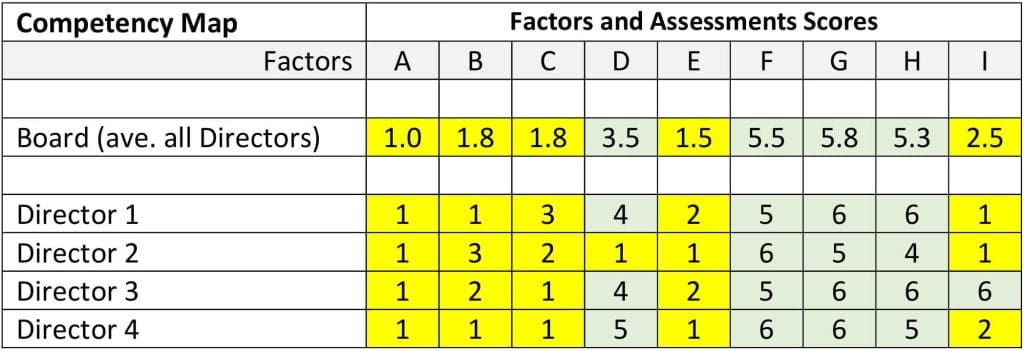

Competency Map – A Simple Illustration:

Given that you have a Board position (all Directors) and individual Director positions, a Competency Map is extremely powerful and helpful in improving the understanding of respective points. It can be summarised and highly visual, so easy to understand complexity.

Yellow Highlight = Requires Attention Green Highlight = Satisfactory

Rating of Factors in accordance with GRC Consulting Framework.

Competency Map – Performance Assessment and Decision Actions:

From the above, it is straightforward to see that the Board, while marginal on Factor D, is overall “Satisfactory” (Highlighted in Green) on Factors D; F; G; and H and may, at face value, warrant no further attention.

Also, within this “Satisfactory” group, the lower scoring individual Directors scoring a “4” can be easily identified and helped with specific assistance to improve their position and performance. This may be easily achieved from internal resources and at very low costs, such as specific executive management briefings – the crucial point is the ease of identification from the Competency Mapping.

The Board and Director positions Highlighted in Yellow are again easily identifiable and, depending upon the nature of each, may receive particular attention or general assistance, but in all cases, to Improve the Performance of the individual Directors and, in so doing, the Board’s performance.

Competency Map – Director Replacement – Head Hunting and Advertising:

Assume for discussion, as often happens in reality, Director 2 tenders his resignation. The Board now has to find a suitable replacement. Further, as may often occur, the Board will secure the services of an appropriate Head Hunter, who will advertise, screen, and provide a short-list of possible candidates for the Board / Nomination Committee / Board Secretary and Chair to interview!

By reviewing the Competency Map, the Board can quickly ascertain that a replacement with a strong rating for Factor D will bring the Board’s Performance rating on this Factor to Satisfactory. It will not, therefore, have to take any further actions in respect of performance. Clearly also, the lower ratings Factors may be prioritised to the Head Hunter.

Additionally, which in practice, many Boards have difficulty doing, they will be able to quickly articulate to the Head Hunter a very specific Competency Profile with which to commence his replacement searching. This will significantly enhance the Board’s chances of a suitable Director and more timely replacement, which, courtesy of the Competency Map’s assistance, will lead to the Board improving its performance through the injection of Competencies where specifically required.

Competency Map – Consistency Across the “Board”:

By adopting a Competency-based Board Performance Review approach, the Board is building consistency across the Board, with solid, repeatable foundations that lead to better Board decision-making information and improved competency, therefore, performance.

Following on from the above example, it would be a simple and logical decision to insist that the final candidate or very short list undertake the same Competency-based Board Performance Review to provide the Board with additional decision-making information and ensure that not only are they making the right decision to select the right prospective Director, but they also get off to a running start by having his competency mapping to combine with the Board’s existing position, saving time, effort and costs.

Competency Map – Specific Board Project or Long Term Strategy Change:

Assume for discussion, as often happens in reality, that the Board is faced with considering a new specific project which it needs to view and make a decision on that has material and long-term sustainability implications. This project is in its formative stages with executive management but under various pressures.

As this specific project entails specific competency, which Director 3, under Factor “I”, has a top rating, the Chair with the Board Secretary in discussions with the CEO, is quickly able to ascertain Board capability, approach Director 3 in advance to discuss, and secure his support. Following this, take an early decision to table to the Board in advance of the coming Board meeting a proposal to structure a Special Committee, to be Chaired by Director 3, who has the necessary expertise within the Board.

This is a specific practical example faced by many Boards where having invested in Competency-based Board Performance Reviews, they can outperform their competitors and Board peers quickly and effectively.

The same is true when reviewing the Board’s Competency in light of likely long-term strategy changes driven by the business’s needs. The Board, which has invested in Competency-based Board Performance Reviews, is far more capable of taking a proactive, thoughtful review of its capabilities and make better and more informed decisions relative to future strategy that results in improved Board decision-making and performance.

Competency – Building a Board Winning Performance Infrastructure:

In a world of increasing change, one of the biggest failures of a Board, and yet one of its most significant challenges, is to innovate to maximise performance, to bring into practice those changes necessary for the Board and organisation to meet the future and perform and succeed on a long-term sustainable basis.

To innovate, the Board must first be open to considering and implementing new ways of measuring, monitoring, adjusting and managing their performance. The best-performing Boards do not wait for Corporate Governance frameworks to emerge. They are constantly developing, progressing, building, measuring, considering, and actioning change and building solid foundations to ensure they are best prepared for the future.

Board Performance Reviews, the focus of this article, is but one such component, vital as it may be. To help round the scope of this article, it is appropriate to consider those additional steps that high-performing Boards are taking and implementing to build robustness into their competency and performance.

Approach – High Performing Boards:

These high-performing Boards are building the culture that they are the current Stewards of the Board and organisation for the future and that it is their current mandate to build a stronger foundation than they found, leave a Board and an organisation better placed than it was today, from which the future Board and organisation will continue to grow its business and prosper. Humility, but with a view on the bigger picture of the issues shaping our society and the organisation’s business environment, not concerned with the immediacy per se, not how the organisation spends its money but how it makes its money with the sustainable longer-term in focus, and making sound judgements based on well thought through Board sessions, processes, structures, purpose and vision.

Best Practices – High Performing Boards:

Financial and Business Literacy – To ensure that more Directors have a greater capacity to understand business financial, integrated and sustainability matters and their formal reporting, spending more time on these matters to achieve sustainable development in an increasingly resource-constrained and interconnected world.

Value Creation – To have foremost at Board and organisational leadership level, how financial and performance results are achieved matters increasingly and cannot be at the expense of destroying value for society and the business environment in which the Board and organisation operate. It is about the “value-creation process” rather than profitability, and at the expense of all else.

Stakeholders – Whether board seats or the broader organisation, the Board has to become more aware, current and informed by and on all stakeholders and respective positions.

Integrated View – The Board and organisations need to have a better understanding and view of the integrated world they operate in, the integrated organisations that they manage, the integrated way in which they need to lead and manage ethically and effectively, and the need for better unit integration, such as over Governance, Risk and Compliance and Board oversight, and ultimately, understanding the simple – inputs – process – and outcomes, whether Board agenda or organisational operations and performance.

Correct Focus – The Board has to be better placed to deal with the most important matters and have robust processes to ensure this focus. This extends through the greatest risks to the business into its greatest opportunities, carefully and robustly considered, thoughtfully weighed, and properly acted upon to success.

Better Information – the Board must be proactive in ensuring that it receives the best and most current information for its purposes and well ahead of schedule. Further that it develops its relationships for trust and transparency with executive management and outside resources as needed to achieve these goals. Work cross-functional teams between Board Directors and executive members with robust, transparent controls and reporting to deliver improved quality information to the Board.

Better Board Performance Processes – The Board adopts and implements improved Board processes for rapid real-time self-feedback and improvement whilst recognising and embracing a shorter Competency/Performance oriented Board Performance Review cycle tied into continuous Board improvement processes and development actions. These may include:

- Cross-functional teams responsible for preparing better Board information.

- Increased access to outside the organisation advisors and expertise.

- Improved Director induction and ongoing development programs.

- Improved executive management business briefings and Director training.

- A clear and continually updated Board Succession Plan for Chair and Directors.

- A clear and continually updated CEO Succession Plan.

- A clear and continually updated senior executive development plan.

- External Independent Competency Performance Board Review every two years.

- Chair, Director, Committee Structure individual, peer and 360’ reviews integrated.

- An updated and monitored Board Development Plan tied to Performance Reviews.

- Formal open and transparent performance feedback on all Board and committee meetings/actions effectiveness in real-time.

- Improved Board Agenda formulation processes that are more Director collaborative.

- Independent Director only discussions in meetings with transparency for improvements.

- A focus on culture and respect with robust independent thought and dialogue.

- A focus on Board dynamics, team building and Board effectiveness.

Concluding Comments

The Cadbury Committee in 1992 defined Corporate Governance as “the system by which organisations are directed and controlled” – ( … by the Governing Body/Directors).

King IV, 2016, defined Corporate Governance as “the exercise of ethical and effective leadership by the governing body towards achieving the following governance outcomes: Ethical culture; Good performance; Effective control; and Legitimacy“.

ISO37000:2021 defines the Governance of Organisations as a “human-based system by which an organisation is directed, overseen and held accountable for achieving its defined organisational purpose“.

The current developments and direction of Governance are rapidly changing and expanding. They will continue to do so, as is the global and highly interconnected world in which we operate and the Board and its Directors must position appropriately to perform.

In this article, we have, within parameters, endeavoured to take you on a journey of “Board Performance Reviews” and to help you with the “Factors to Consider” and “well, what now, and how to progress to ensure the best benefit to the Board and organisation”.

In conclusion, and simply stated, improving Competence in ethical and effective leadership through directing, managing and controlling across the spectrum of what best practice directors and governing bodies have to do in practice/”sitting behind the desk”, will lead to Best Practice Performance.

It is harmful to the Board and the organisation if the Board and its Directors do not receive appropriate, regular and critical feedback on their respective performance.

A simple acid test question for Directors on Performance is: “Tell me the one or two things the Board did that made a material and valuable difference?”.

The Board’s Performance – quality decisions and actions – is a severe acid test for Boards and whether they have met the challenge for their organisations and stakeholders in continuously improving their performance, as Directors individually, as the Board collectively and for the organisation overall.

The Board’s improvement processes, which include Board Performance Reviews, are an undisputed component of current successful and leading high-performing Boards.

I thank you for taking the time to read this article and trust that in accordance with our GRC Consulting ethos, it is:

Simple to understand, Simple to implement and Simple to use.

If so, I would be grateful if I may ask of you the following:

1. Share the article on LinkedIn or wider to your fellow Board members, senior executives and company secretaries so that this may be read by more people with the expectation of spreading this positive development and adoption by Boards and their organisations.

2. Like and Comment on LinkedIn, doing so spreads the reach of this article, via the algorithm, to a greater number of readers and I am happy to address your comments.

3. Follow Me on LinkedIn, as I will be writing articles regularly that I hope are of value.

4. Obtain – if you would like to obtain a pdf copy of this article, then please click on the “Link” provided directly below, enter your details and in the “Your Request” dialogue box, enter “Board Performance Reviews”. I will include a value-add document for your Board/to inform your Board Performance Review process.

5. Link – https://grcconsultingltd.com/contact

Yours sincerely,